Due to Covid-19 pandemic, there are rising concerns about the potential transmission of the virus in enclosed spaces such as indoor areas, where air-borne bacteria and viruses can circulate when airflow is restricted. To prevent bad airflow, people are becoming more interested in the air purifying system to lower the risk of getting sick. There are four main types of air purifiers that are used at home .

HEPA Purifiers

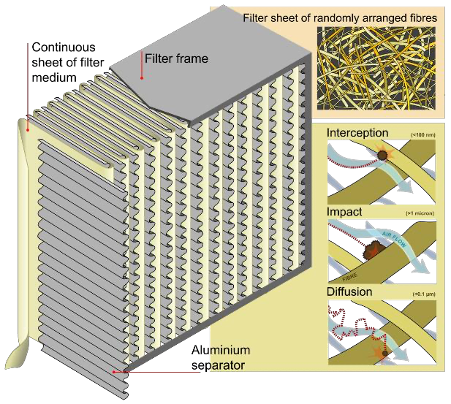

The most common one is the HEPA purifiers. High-efficiency particulate air (HEPA) filters capture airborne particles from moving air using a dense, random arrangement of fibers. HEPA filters use the physics of particles moving through air to yank them out of the airflow. Their operation is simple but extremely effective. They have an efficiency of removing 99.97% of particulate matter of size less than 0.3 microns from contaminated air ensuring a flow rate anywhere between 150 -400 cubic feet per minute depending on the clogging of their pores.

Pros:

Reduces allergy and asthma symptoms:

Particles like dust, dander, and pollen that cause allergy symptoms are large enough for a HEPA filter to catch

Commonly available:

HEPA filters are found in a variety of home appliances including whole-house air filtration units, portable air purifiers, and vacuum cleaners.

Produces no byproducts:

Other air purifying products like ozone, ionizers, and PECO all emit a harmful byproduct into the air.

Cons:

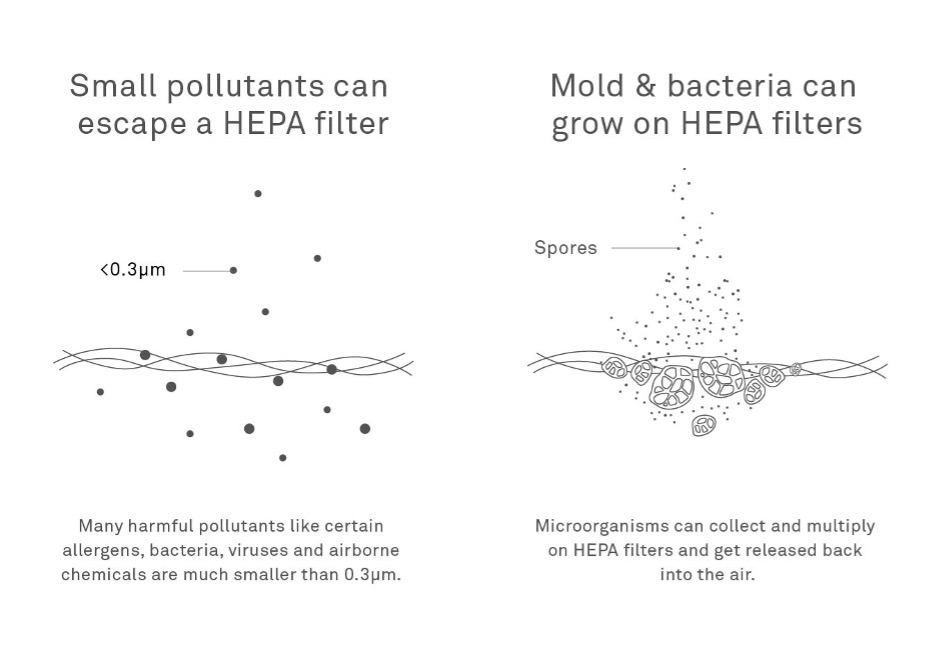

Won’t remove every particle:

will not remove pollutants from the air that are smaller than 0.3 microns, including viruses, some bacteria, and volatile organic compounds (VOCs).

Requires frequent replacement:

HEPA filters trap most of the particulates in the air. This means they tend to clog faster than more porous filters.

Can be difficult to clean:

The shape and size of your air purifier may make it difficult to access the HEPA filter and clean it.

Sources:

The Pros and Cons of Using a HEPA Filter in Your Home Air System

https://molekule.science/pros-cons-hepa-filter/

UV Purifiers

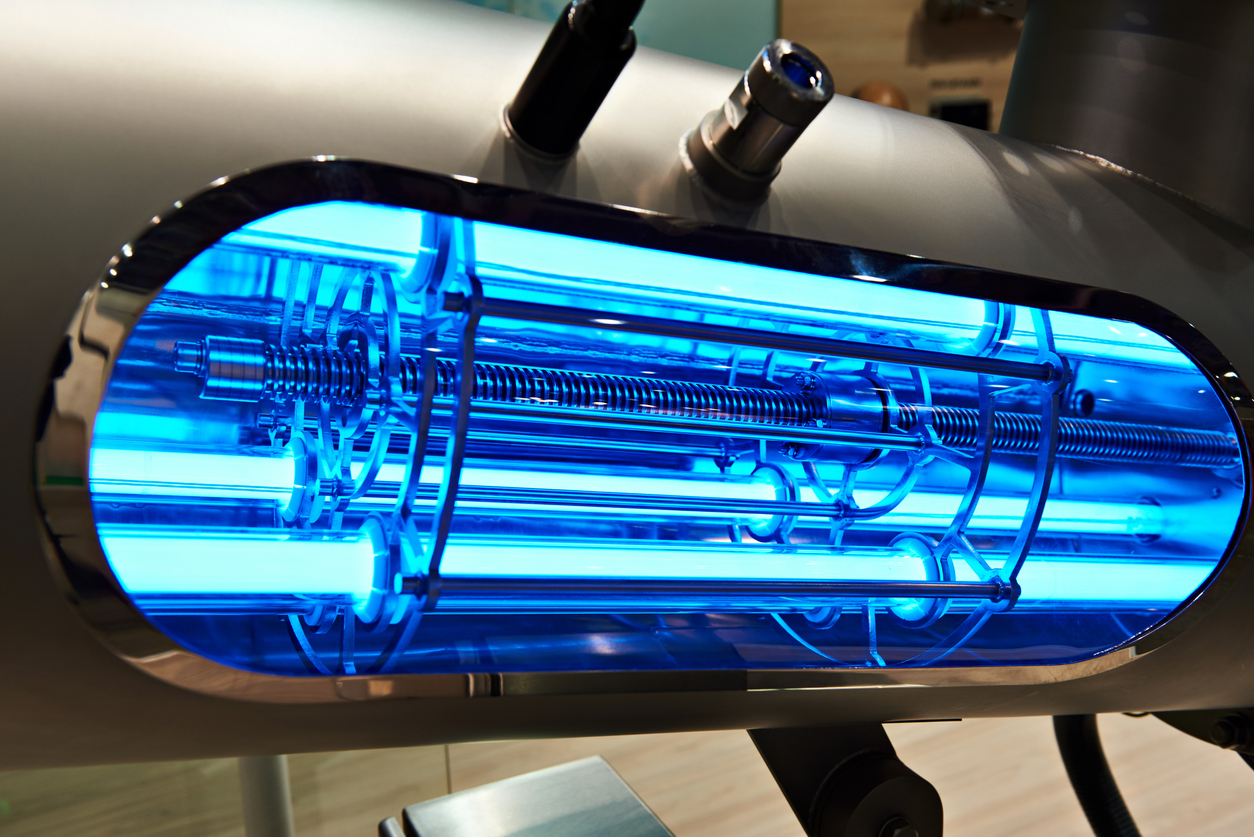

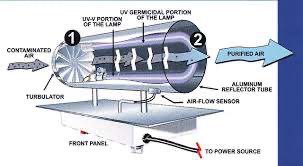

UV stands for ultraviolet. UV Air Filtration is a specialized way of treating your air that reduces biological compounds. It can also help eliminate potentially harmful bacteria and viruses from the air. There are special products that can be installed in addition to the current HVAC systems so that the UV air filtration or UV air purification system purifies the air as it is conditioned by your AC and heating system.

Pros:

Elimination:

eliminate microscopic elements, such as viruses, bacteria, or mold, that can be toxic or harmful

Silent:

you won’t even know it’s running

Won’t accumulate dirt:

there’s no physical filter

Cons:

Won’t remove every particle:

most allergens, dust, or other solids such as cigarette smoke, gases, or other chemical fumes cannot remove.

Require some maintenance:

AirCleaner.org tells us “every year, about 15% of an ultraviolet light’s power is decreased.”

http://www.aircleaner.org/uv-air-purifiers/

By-product created:

When UV purifiers expose air to UV light, the same energy that breaks the bonds of DNA in microorganisms can also split oxygen (O₂), which can reform into ozone (O₃). While beneficial high in the atmosphere, ozone is a dangerous pollution in your home.

Sources:

https://www.comfortexpertsinc.com/blog/2015/april/pros-and-cons-of-uv-air-filtration/

https://www.schnellerair.com/blog/pros-cons-what-you-need-to-know-about-uv-air-filtration/

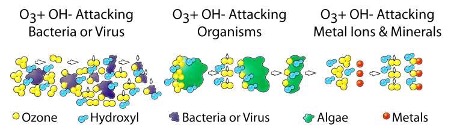

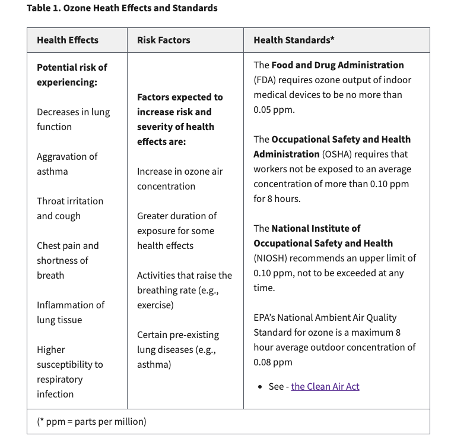

Ozone Air Purifiers

Ozone is a molecule composed of three atoms of oxygen. Two atoms of oxygen form the basic oxygen molecule–the oxygen we breathe that is essential to life. The third oxygen atom can detach from the ozone molecule, and re-attach to molecules of other substances, thereby altering their chemical composition. It is this ability to react with other substances that forms the basis of many manufacturers’ claims.

Pro

more applicable:

applicable for biological contaminants, not airborne inorganic particulates or chemicals

non-occupant settings:

ozone generators can be used to disinfect the air and kill microbes

Con

immediately harmful to your health:

ozone can damage the lungs. Relatively low amounts can cause chest pain, coughing, shortness of breath and throat irritation.

leaving byproducts:

just as bad or even worse than the original chemicals.

Sources:

https://www.epa.gov/indoor-air-quality-iaq/ozone-generators-are-sold-air-cleaners#intro

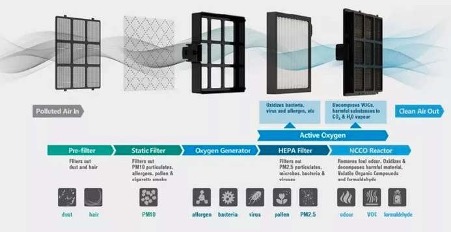

NCCO Purifier

NCCO is an innovative technology invented by members of HKUST Entrepreneurship Program. It has been well recognized by the Hong Kong government and the public sector and is a revolutionary air purification technology that will change the world.

In comparison to other air purification technologies such as activated charcoal, UV light and electrostatic precipitator. NCCO is more efficient at removing pollutants. For example, activated charcoal can only absorb but not decompose pollutants, and can only last for a short period of time (usually three months) without replacement. Once the carbon filter is saturated, the pollutants absorbed will be released to the air causing “second pollution”, which can cause great harm to health.

On the other hand, NCCO can absorb and decompose pollutants continuously by combining Active Oxygen and High grade synthetic zeolite, and the technology can last for up to 12 years in a laboratory environment. NCCO has solved a range of air pollution issues in different sectors including commercial, industrial, retail and motor etc. In addition, it can resolve indoor and outdoor air quality problems including pollution caused by PM2.5, PM10, VOCs and formaldehyde. Being able to remove the root sources of pollutants, NCCO acts as an excellent air purifier. Being a proven concept with these capabilities, NCCO is playing an important role in air purification technology development.

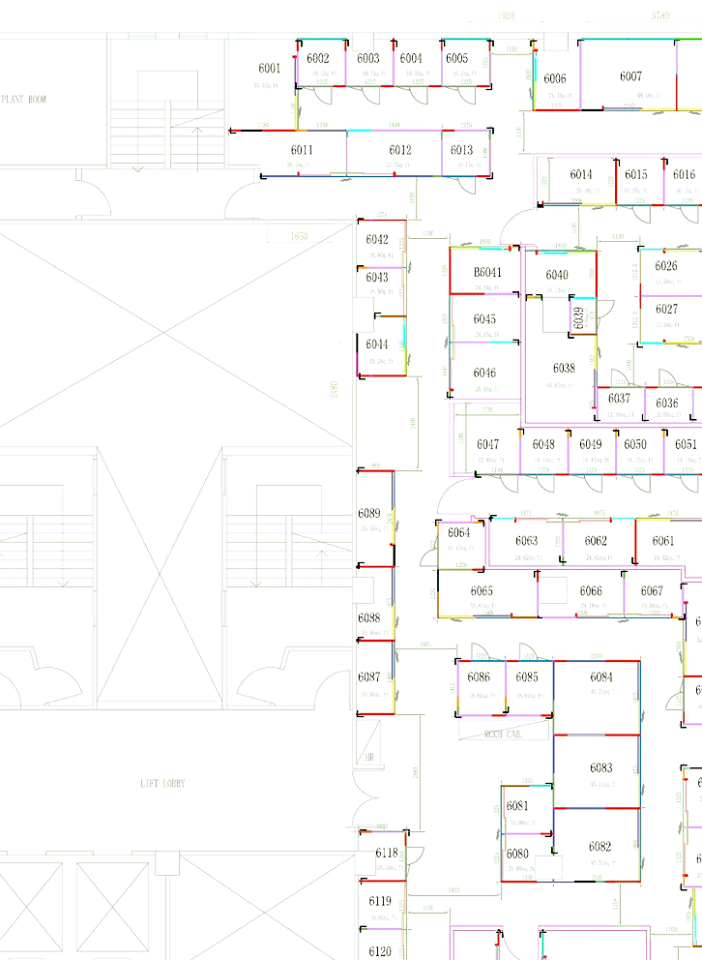

Application for NCCO Purifier

fan coil system

Office Ceiling

Lift

Recent Comments