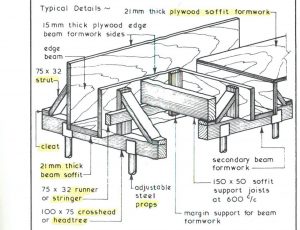

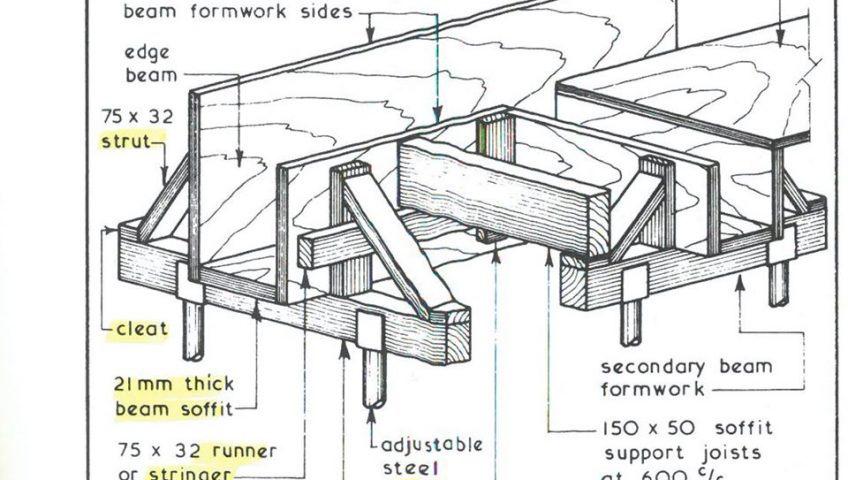

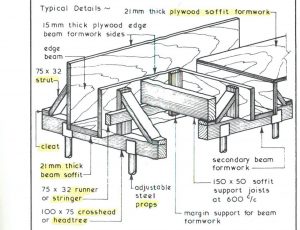

Timber formworks is the most common for concreting. In general specification of government Edition 2017 GS 2017-02, section 6 emphasizes the formworks requirements. Seldom is discussed the requirement for basic component of formworks and how it affects the construction quality.

The stratum, the propping, falsework, crossing bracing, head tree, purlin/runner and plywood soffit are all critical components to affect the formworks stability, concrete quality, the finishes level and the subsequent follow up works.

Credit:

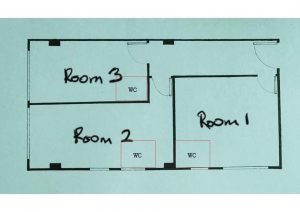

Drawing extracted from R.Chudley 2nd Ed Building Construction Handbook.

Photo : Construction Project under GBE inspection.

Recent Comments